ev charger tax credit 2020

Several states and local utilities offer electric vehicle and solar incentives for customers often taking the form of a rebate. Keep in mind that you need to have a tax liability in other words you need to owe taxes in order to claim a tax credit.

Rebates And Tax Credits For Electric Vehicle Charging Stations

If you use the 14-50 outlet to charge an electric vehicle then it is eligible.

. Congress recently passed a retroactive now includes 2018 2019 2020 and through 2021 federal tax credit for those who purchased EV charging infrastructure. Grab IRS form 8911 or use our handy guide to get your credit. Tax Incentives Registration or Licensing Fuel Taxes Loans and Leases Fuel Production or Quality Rebates Renewable Fuel Standard or Mandate.

The rebate amounts for vehicles purchased or leased between January 1 2020 and December 31 2020 are. Up to 1000 Back for Home Charging. Consumers who purchase qualified residential fueling equipment prior to December 31 2021 may receive a tax credit of up to 1000.

In a late December session congress passed a bill that extended the electric vehicle charging tax credit that will cover 30 of the cost for residential or workplace charging. What You Should Know. Personal Vehicle Owner or Driver.

This incentive covers 30 of the cost with a maximum credit of. Central Iowa Power Cooperative CIPCO residential customers are eligible for a 500 rebate on the purchase or lease of a plug-in electric or plug-in hybrid electric vehicle. Small neighborhood electric vehicles do not qualify for this credit but.

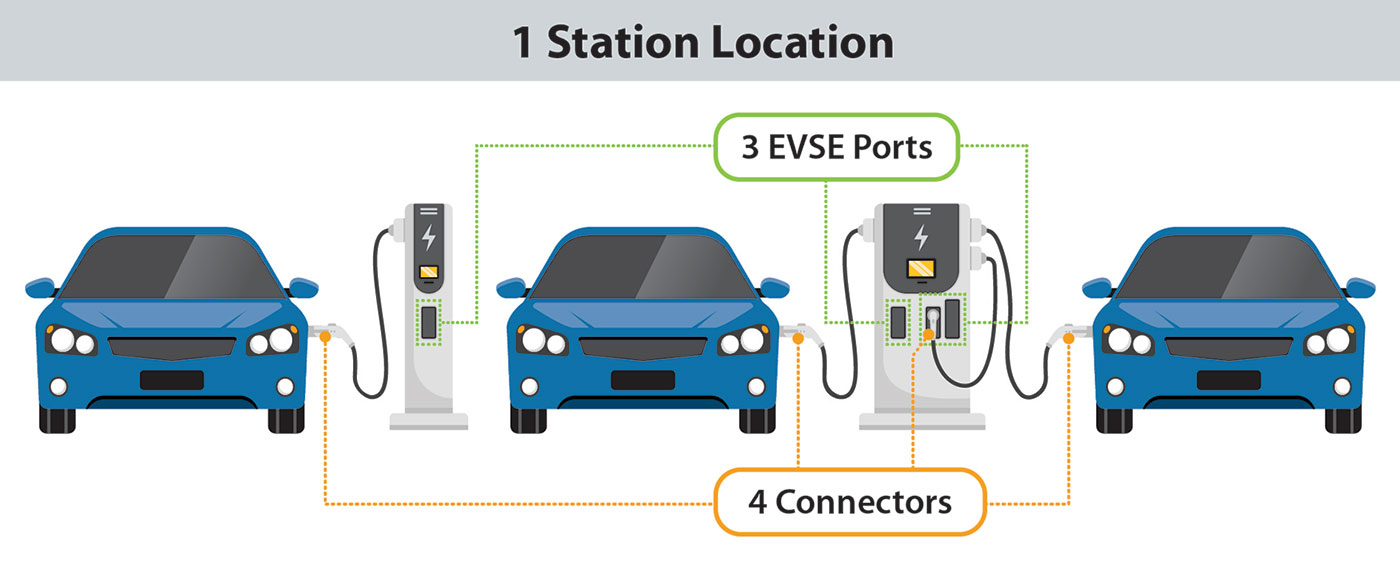

Right-to-Charge Other Incentive Other Regulation User All. Fueling station owners who install qualified equipment at multiple sites are allowed to use the credit towards each location. However I cant find any evidence of this being valid past 123121.

If you installed charging equipment after January 1 2017 or if you install equipment before the end of this year you are eligible to claim this credit up to 1000. It covers 30 of the costs with a maximum 1000 credit for residents and 30000 federal tax credit for commercial installs. 421 rows All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500.

Bought Model 3 in Jun 2019 and bought and installed the wall charger as wellplus 3750 tax creditmaybe I wont have. State tax credit equal to the lesser of 35 of. It covers 30 of the costs with a maximum 1000 credit for residents and 30000 federal tax credit for commercial installs.

The credit amount will vary based on the capacity of the battery used to power the vehicle. Because the EV charging tax credit got passed right at the end of 2019 there has been very little information available for you to file your 2019 taxes. The credit ranges between 2500 and 7500 depending on the capacity of the battery.

The credit begins to phase out for a manufacturer when that manufacturer sells 200000 qualified vehicles. Start date Dec 19. FEDERAL TAX CREDIT FOR EVSE PURCHASE AND INSTALLATION EXTENDED.

But Uncle Sam is not the only. The credit for the charging station in a nonrefundable credit. A federal tax credit of 30 of the cost of installing EV charging equipment which had expired December 31 2016 has been retroactively extended through December 31 2020.

Form 1041 Schedule G. Receive a federal tax credit of 30 of the cost of purchasing and installing an EV charging station. Alternative Fueling Infrastructure Tax Credit State EV Charging Incentive.

Were EV charging pros not CPAs so we recommend getting advice from your own tax professional. Youll need to know your tax liability to calculate the credit. You may be eligible for a credit under section 30D g if you purchased a 2- or 3-wheeled vehicle that draws energy from a battery with at least 25.

2020 to December 31 2022. Alternative Fuel Infrastructure Operator. Under the Biden administration there are high hopes that these EV charging tax credits will continue and even expand.

Sales of 2022 of Electric Vehicles continues go grow. EVSE Tax Credits. January 1 2023 to December 31 2023.

Permitting and inspection fees are not included in covered expenses. The federal government offers a tax credit for EV charger hardware and EV charger installation costs. Previously this federal tax credit expired on December 31 2017 but is now extended through December 31 2021.

And its retroactive so you can still apply for installs made as early as 2017. Congress recently passed a retroactive now includes 2018 2019 2020 and through 2021 federal tax credit for those who purchased EV charging infrastructure. Credits on Form 1040 1040-SR or 1040-NR line 19 and Schedule 3 Form 1040 lines 2 through 5 and 7 reduced by any general business credit reported on line 6a any credit for prior year minimum tax reported on line 6b or any credit to holders of tax credit bonds reported on line 6k.

New Federal EV Charger installation rebate for 2020 is retroactive back through 2018. This federal EV infrastructure tax credit will offset up to 30 of the total costs of purchase and installation of EV equipment up to a maximum of 30000 for commercial property and 1000 for a primary residence. State andor local incentives may also apply.

2500 for EVs and 1500 for hybrids. Complete your full tax return then fill in form 8911. Enter the total of any write-in.

Receive a federal tax credit of 30 of the cost of purchasing and installing an EV charging station up to 1000 for residential installations and up to 30000 for commercial installations. Just buy and install by December 31 2021 then claim the credit on your federal tax return. In addition to the electric vehicle tax credit the federal government has approved an extension of the credit for alternative fuel vehicle refueling propertyFirst implemented in 2017 the tax credit expired in 2018 and was retroactively extended through 2020 making all charging stations purchased through December 31st 2020.

The federal government also offers drivers a variety of rebate programs that can be used to offset part of the costs to purchase residential EV chargersAs of February 2022 residents in any state can get an income tax credit to help defray the cost of both EV chargers and EV charger installations. The charging station must be purchased. President Bidens Build Back Better bill would increase the electric car tax credit from 7500 to 12500 for qualifying vehicles however this bill has only passed and not the Senate as of April 2022.

Receive a federal tax credit of 30 of the cost of purchasing and installing an EV charging station. Federal tax credit gives individuals 30 back on a ChargePoint Home Flex EV charger and installation costs up to 1000. Carpool lane access and reduced rates for electric vehicle charging.

In 2021 United States electric vehicle sales grew to over 430000 increasing from 2020. The federal government offers a tax credit for EV charger hardware and EV charger installation costs. A non-refundable tax credit is a tax credit that can only reduce a taxpayers liability to zeroThe credit cant be used to increase your tax refund or to create a tax refund when you wouldnt have already had one.

Zero Emission Vehicle Charging Stations

Besenergy Ev Charger Level 1 J1772 Evse 25ft Home 110v 120v Ip65 15a Portable Charge Station Compatible With All Ev Cars Amazon Ca Automotive

Charging Nissan Leaf Leaf E Plus Range Charging Time Type How Much Does It Cost To Charge E Mobility Simplified Basic Nissan Leaf Nissan Ev Charger

Do I Have To Pay To Charge My Electric Car Autotrader

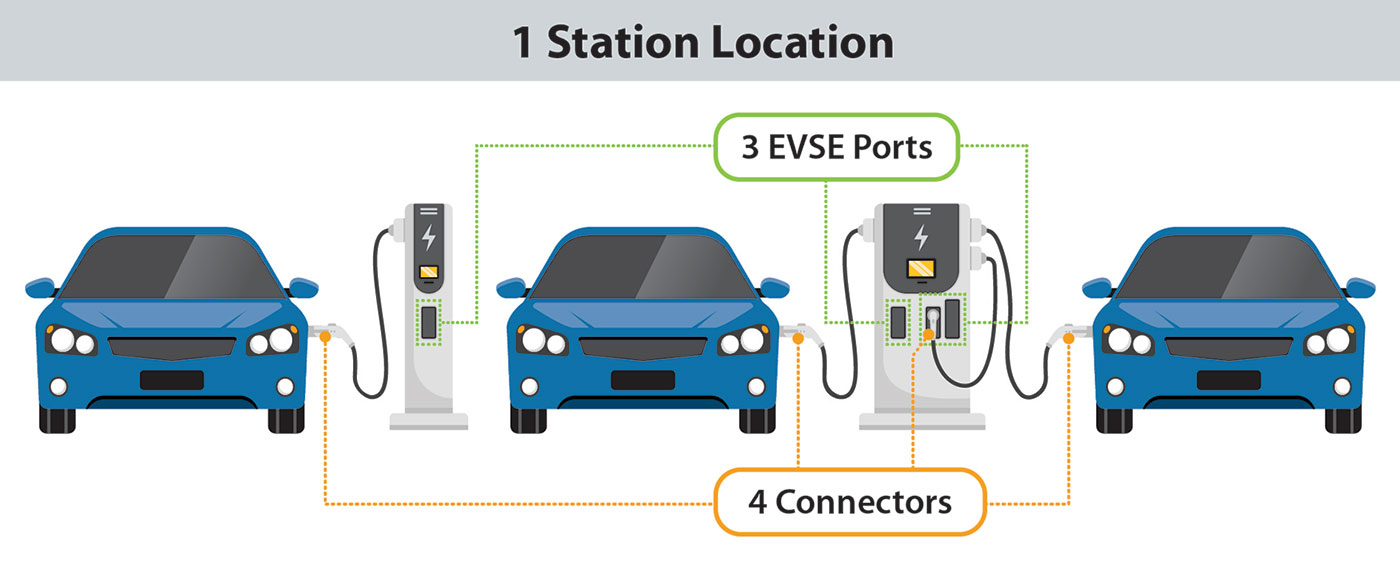

Bidirectional Chargers Explained V2g Vs V2h Vs V2l Clean Energy Reviews

Electric Car Chargers Ev Charging Stations Evse Smart Charge

Tax Credit For Electric Vehicle Chargers Enel X

Charging And Driving An Ev In The Rain Or Winter Snow Answering Common Questions Smart Electric Vehicle Ev Charging Stations

What S In The White House Plan To Expand Electric Car Charging Network Npr

10 Must Read Ev Charger Installations Faq Home Ev Charger Install Sun Electrical In Calgary

How To Claim Your Federal Tax Credit For Home Charging Chargepoint

How To Claim An Electric Vehicle Tax Credit Enel X

Edmonton Electric Vehicle Ev Charging Rebate Program

Chargepoint Home Flex Electric Vehicle Ev Charger 16 To 50 Amp 240v Level 2 Wifi Evse Nema 14 50 Plug Or Hardwired Indoor Outdoor 7 M Cable Amazon Ca Automotive

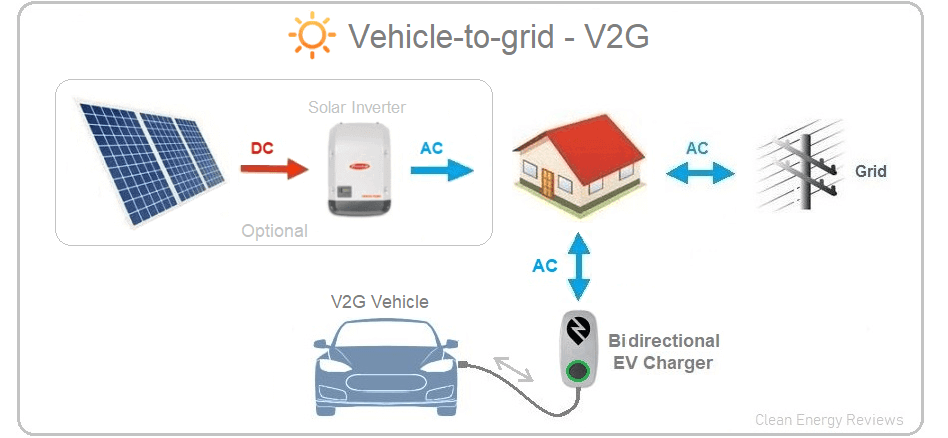

Best Ev Chargers For 2022 Tested Car And Driver

/cdn.vox-cdn.com/uploads/chorus_asset/file/22633236/1232464562.jpg)

The Fastest Way To Get More People To Buy Electric Vehicles Build More Charging Stations Vox

2022 Ev Charging Stations Cost Install Level 2 Or Tesla

Ev Tax Credit Plan Disappoints It S A Setback For Tesla And Its Rivals Ev Charging Stations Electric Charging Stations Lithium Ion Batteries